wAmong the most favoured places of international students worldwide, studying abroad in Singapore is probably one of your study destination goals, too! Here’s a quick yet detailed guide to the country, what to expect and what not to expect – as well as the top universities and how they stack up against the top institutions in the world.

1. A Quick Intro to Singapore

2. Why Study in Singapore?

3. Higher Education in Singapore

A. Higher Education Institutions in Singapore

B. Pathway to Studying in Singapore

C. Top Institutions in Singapore

D. After Study Opportunities in Singapore

4. Applying to Study in Singapore

A. Language Requirements

B. Visa Requirements

5. Tuition Fees

6. Top Courses in Singapore

7. Frequently Asked Questions

1. A Quick Intro of Singapore

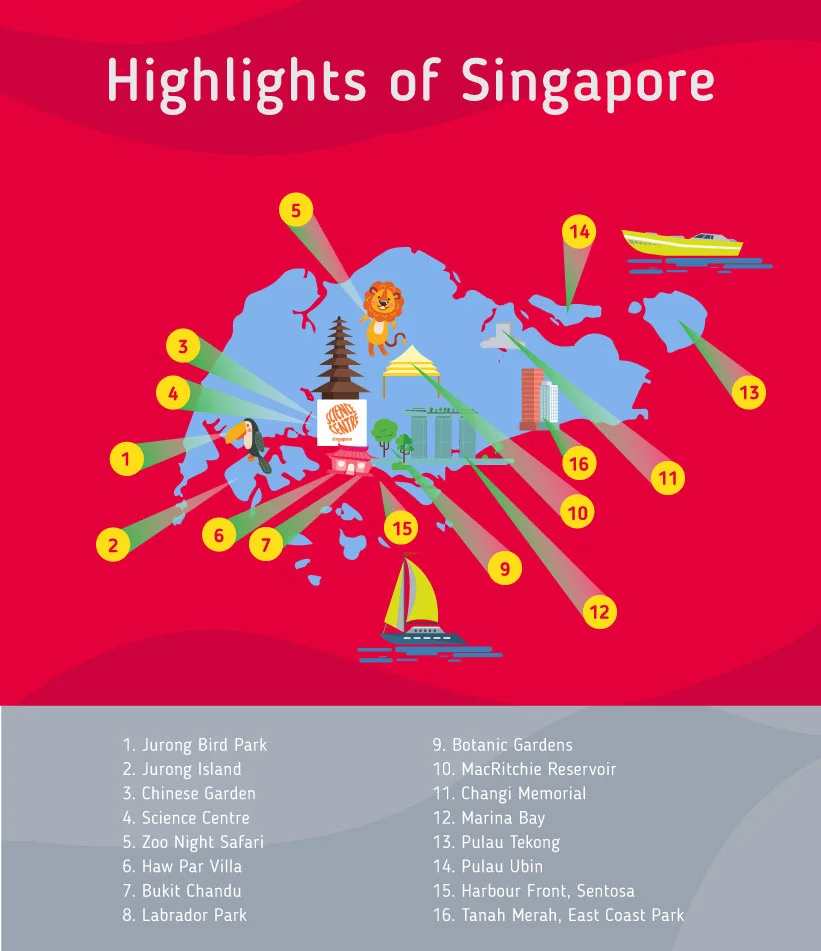

Singapore is known for being a developed country with leaning skyscrapers and diverse communities despite its young status. As Southeast Asia's most modern city for over a century, the island is also home to various culture living within it. There is a very diverse way of life with people speaking many languages and practising different culture. Such wide range of culture makes the country very accepting of others turning it into the perfect study destination for students from all parts the world.

2. Why Study in Singapore?

Singapore is considered to have one of the best education systems in the world. Getting an education here is a ticket to a brighter future. By focusing on the importance of education innovation, Singapore is currently a rising star in the international higher education. This gives you a chance to earn an internationally-recognised degree at affordable costs. Also, thanks to the facilities and educational environment, universities and colleges in Singapore are among the best in the world.

As a country, Singapore is known for its diverse, beautiful and vibrant place to live, but did you know that it also excels in terms of safety? Singapore was named as one of the world's safest cities. This makes it a perfect place for students who are usually also the curious wanderers in a foreign country.

And not to forget, thanks to the country's strategic location, you will be really surprised at the possibility of going to places within your reach while studying in Singapore. After all, life is not all about simply getting good grades, it’s also a time to explore!

3. Higher Education in Singapore

Singapore is an emerging hub of higher education with its world-renowned quality universities and colleges which are well-presented in major university ranking systems. Not only are the universities here rank high due to their proven track record, but Singapore itself is on top of student satisfaction and global reputation.

The country's highest ranking institution, Nanyang Technological University (NTU) is not only the highest ranked in the country and Asia, but it is also listed as the top 11 universities in the QS World University Ranking 2018. National University of Singapore (NUS) is also not far behind at Top 15.

A. Higher Education Institutions in Singapore

The higher education system in Singapore offers a range of different educational profiles and degrees. Below are the different type of higher education institutions in Singapore

| Public Universities | Funded by the government, and open to local and international students. Although receives government funding, these universities are autonomous – meaning the can strategise, innovate, and differentiate themselves, as they pursue excellence in education, research, and service |

| Private Universities | Although privately funded, this institution receives government funding for students to pursue subsidised part-time or full-time degree |

| Polytechnic Institutions | Offers practice-oriented studies at diploma level. Key providers of continuing education and post-employment professional development services. |

| Institute of Technical Education (ITE) | The ITEs Offers technical-oriented studies and develops technical knowledge and skills of the students. Students will have the option of choosing between full or part-time educational or traineeship courses |

| Foreign Universities | Offers undergraduate and postgraduate degrees offered by the foreign universities with branch campuses in Singapore. |

| Arts Schools | Specialised schools that offer specialist creative education to enhance your artistic ability. Offer diploma as well as degree courses. |

B. Pathway to Studying in Singapore

The length of your study depends on the path you wish to pursue. To understand this better, refer the infographic below:

C. Top Institutions in Singapore

While only two Singaporean universities appear in the QS World Rankings 2021, the rest of the universities listed below remain exceptional within the country as well.

D. After Study Opportunities in Singapore

Options are plenty for those who have just completed a degree in Singapore. Although getting a job in Singapore is not as easy as what it may seem, the country does have a high demand for excellent foreign talent in certain fields. If you wish to stay in Singapore, you will need to check your visa requirements. You may visit the ICA - Immigration & Checkpoints Authority website to see your visa options.

4. Applying to Study in Singapore

A. Language Requirements

International students wanting to pursue higher education in Singapore should know that English is the medium of instruction used in this country despite having four official languages.

Singapore universities have high entry standards especially when it comes to the English language. Universities will most likely not accept anyone without a good command in English.

For international students whose mother tongue is not English, the universities will set their own required IELTS/TOEFL scores and students are expected to meet these requirements.

B. Visa Requirements

To study in Singapore, students will need a Student’s Pass. Some students will need a visa to enter the country along with a Student’s Pass. Once you are accepted into your university of choice, your student visa will be applied for by the university itself.

However, you must apply for a Student Pass to the Immigration & Checkpoints Authority (ICA) through the Student’s Pass Online Application & Registration System (SOLAR), between one to two months before the start of your course. You would access SOLAR using details provided by your university after acceptance, and submit:

- eForm 16

- Passport details

- Your university’s address

- Your email address

- A passport sized photo

Following your arrival in Singapore, you would be required to visit the ICA for the collection of your Student Pass, inclusive of a fee of S$60.

Did you know? The process of application for a Student’s Pass is similar for students who require and visa and for those who don’t – only difference is that if you need a visa, you will have to complete your Student’s Pass application from your home country. Students who do not require a visa to enter Singapore, on the other hand, may apply for a Student’s Pass once they are already in the country. Do note that only students from some nationalities will need a visa to enter Singapore.

5. Tuition Fees

One of the main concerns students will have on their mind when deciding to study abroad is the tuition fees and the expenditure they would have to bare over the cost of their studies. Below is a table on the estimated tuition fees for each programme to help you plan your budget before deciding to study in Singapore.

| Study Level | Tuition Fee, SGD/year | Tuition Fee, USD/year |

|---|---|---|

| Foundation / Pre-U | S$ 12,000 – S$ 18,000 | $ 8,800 – $ 13,000 |

| Diploma | S$ 6,000 – S$ 18,000 | $ 4,400 – $ 13,000 |

| Bachelor's degree | S$ 30,000 – S$ 60,000 | $ 22,000 – $ 44,000 |

| Master's degree | S$ 30,000 – S$ 50,000 (non-medical programmes) S$ 50,000 – S$ 90,000 (medical programmes) |

$ 22,000 – $ 36,000 (non-medical programmes) $ 36,000 – $ 65,000 (non-medical programmes) |

6. Top Courses in Singapore

Ready to Study in Singapore? Check out the top courses and where to study below. Here is a list of the universities of the top courses in Singapore:

7. Frequently Asked Questions

How can I get scholarships to study at Singapore?

Singapore offers scholarships for students for various levels of education and programs. For each scholarships, the requirements are different. Get access to the available scholarships here.

Can I work while studying in Singapore?

With a Work Pass Exemption, International students are allowed to work a maximum of 16 hours per week in Singapore.

+60173309581

+60173309581