What to Know Before Applying for a Student Loan

November 11, 2017

EasyUni Staff

Applying for a loan might seem a tremendous task when you are just getting started. However, once you have equipped yourself with the necessary information, it is actually not that hard. You just need to start early and keep track of the deadline so that you don’t miss it.

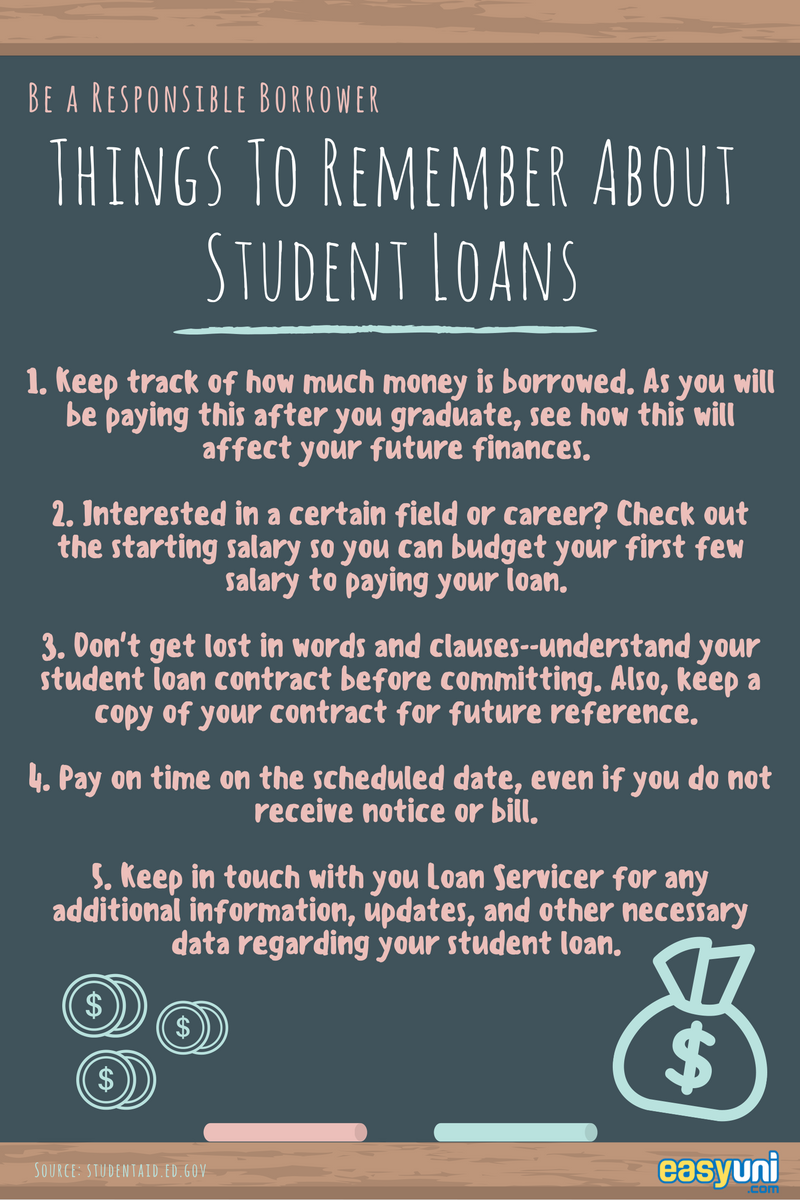

Like any car loan and home mortgage, student loans also must be repaid with interest and the first payment is usually required six months after graduation, regardless of whether you are employed or not.

The interest rate on a subsidised loan should be a key factor in your financial planning as it begins accruing interest while you are in school. Different loans also have different interest rates. So, don’t neglect the fees that come with most student loans.

You also need to create or get a personal identification number (PIN) and use it throughout the process of applying for and repaying your student loans. Then, visit the government website to download a list of all the documents that you will need in completing your loan application. After the closing date, you will know whether you are eligible for the loan and the amount that you are entitled to.

The final step in applying for student loans is to accept your financial aid reward package and sign the promissory note outlining the details of the loan, interest rates and terms of repayment. For first-time student loan borrowers, they are usually required to attend a brief counseling session in most institutions.

- Check Out: Seven Ways to Fund your Study Abroad

Keep in mind that this does not mean that you can slack in your academic performance as they have a minimum requirement to continue receiving the loans. That means that there is a certain grade point average you will have to maintain or at least avoid being under academic probation.

Despite the burden of debt after graduation, borrowing under these programmes is a great way to pay for an education that might otherwise be out of reach.

Just try to make the best out the borrowing opportunity by using the loans with the most favorable terms first and managing your funds wisely in school while handling your debt responsibly after graduation.

.com.webp)

You might be interested in...

- Global Learning at the Crossroads: Canada–Malaysia’s Evolving Education Partnership

- How AI is Powering the Next Wave of MSME Growth in Malaysia

- Malaysian Private Universities Making a Mark in Global Rankings

- Benchmarking Malaysian Private Universities Against Their ASEAN Peers

- Step-by-Step Guide to Applying to Malaysian Universities Online in 2025

- Fastest-Rising Malaysian Universities in the QS Rankings (2023‑2025)

- Sunway University Climbs to Global Top 500 in QS Rankings 2026

- Trusted by Top Universities: EasyUni’s Exclusive Visit to Sunway University

- Wawasan Open University and Sophic Automation Partner to Offer Work-Based Learning for Engineering Students

- Sunway University: Malaysia’s Best Cambridge A-Level College with 11 Years of Excellence

+60173309581

+60173309581